Dilution

When a company raises new capital through a round of financing, it typically issues new shares of its stock to the investors who provide the funds which dilutes existing shareholders. Dilution can also occur if a company issues stock options or warrants as part of a financing round. These securities give the holders the right to buy shares of the company at a set price, and when they exercise that right, it further dilutes the ownership of existing shareholders.

The amount of shares that previous shareholders will have previously held will be the same (without the acquisition of new shares) while the total amount of shares will have increased. The increase in the total number of shares by the addition of new shares is called dilution and reduces the ownership stake of existing shareholders.

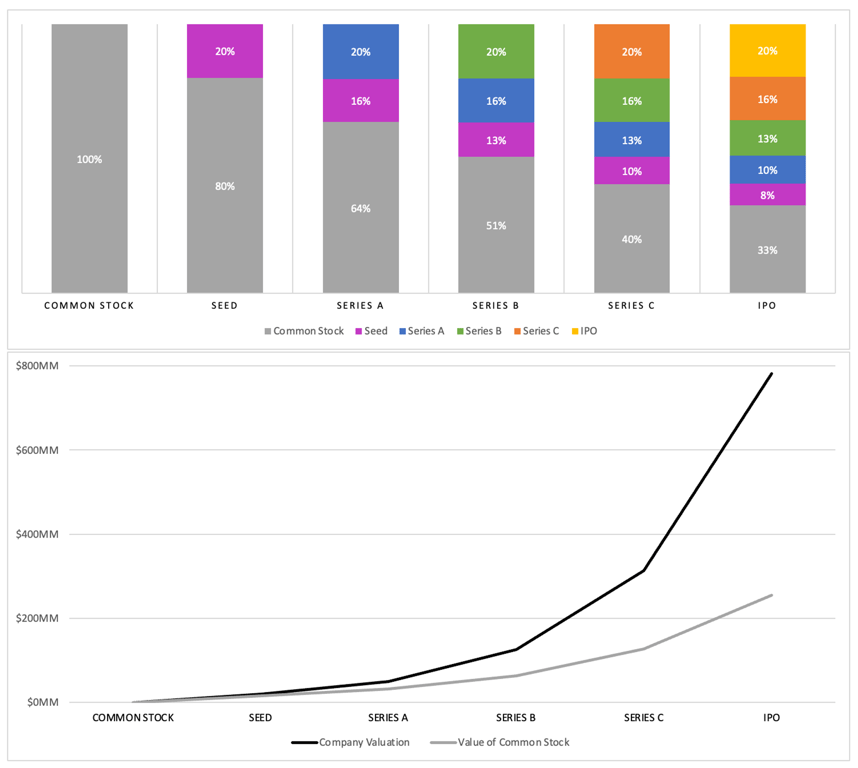

If a company currently has 1,000,000 shares outstanding and you own 100,000 of them, or 10% of the company. If the company then issues another 1,000,000 shares in a new financing round, your 100,000 shares now represent only 5% of the total shares outstanding. An alternative example with a lower total share count follows in the diagrams below.

pie showData "Other Common Stock" : 10 "Other Common Stock" : 90

pie showData "Common Stock" : 100 "New Investor" : 25

Dilution and Valuation

The lower ownership stake associated with dilution is usually accompanied by an increased value of the company. Dilution will mean owning a smaller fraction of a more highly valued pie.

(The following graph is for illustration purposes only.)